Effective billing practices are vital for ensuring a steady cash flow and maintaining strong client relationships. However, businesses often encounter common billing mistakes that can lead to inefficiencies, delays, and financial losses. This article highlights these mistakes, how to prevent them, the tools that can enhance billing accuracy, and the potential consequences of poor billing practices.

Common Billing Mistakes

- Inaccurate Invoices: Errors in client details, item descriptions, or pricing are frequent billing mistakes that create confusion and delays.

- Late Invoice Delivery: Sending invoices late disrupts payment cycles and can harm cash flow.

- Lack of Clear Payment Terms: Failing to define due dates, late fees, or accepted payment methods can result in misunderstandings and delays.

- Duplicate Invoices: Sending the same invoice multiple times can frustrate clients and damage professional relationships.

- Unorganized Records: Poorly maintained invoice records make tracking payments and resolving disputes challenging.

- Ignoring Overdue Payments: A lack of follow-up on overdue invoices can lead to unpaid bills and revenue loss.

How to Prevent Billing Errors

Preventing billing mistakes requires implementing strategies to ensure accuracy, timeliness, and efficiency.

- Double-Check Information: Always review client details, pricing, and payment terms before sending invoices. Ensure consistency across all billing documents.

- Standardize Invoicing Procedures: Develop a standardized process for invoice creation and delivery to reduce inconsistencies and errors.

- Set Clear Payment Terms: Clearly outline due dates, late fees, and accepted payment methods on every invoice. Transparency helps clients understand their obligations.

- Automate Billing Processes: Use software to automate invoice generation, delivery, and follow-ups. Automation minimizes human errors and ensures consistency.

- Track Payments Regularly: Monitor payments to identify overdue invoices early. A proactive approach can help address payment delays promptly.

- Maintain Organized Records: Keep detailed, well-organized records of invoices, payments, and communications with clients for easy reference and dispute resolution.

Tools for Billing Accuracy

Modern tools can greatly enhance billing accuracy and streamline processes. Here are a few recommended solutions:

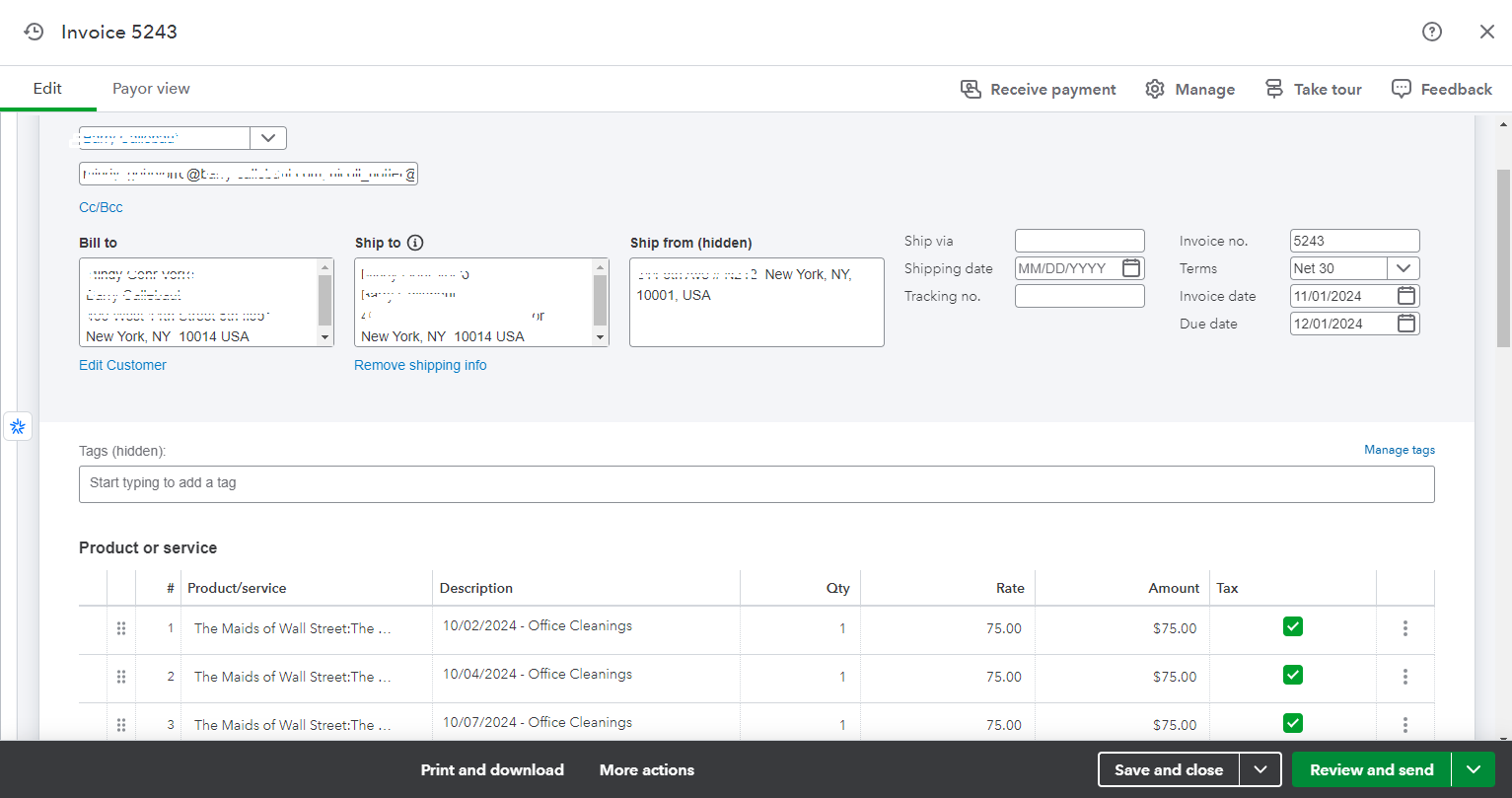

- Billing Software: Platforms like QuickBooks, FreshBooks, and Xero allow businesses to create professional invoices, track payments, and automate reminders.

- Time Tracking Software: For service-based businesses, tools like Toggl and Clockify help accurately record billable hours, ensuring clients are billed correctly.

- Payment Gateways: Integrating secure payment gateways like Stripe or PayPal into invoices allows clients to pay directly, reducing errors and improving cash flow.

- Cloud Storage Solutions: Tools like Google Drive or Dropbox ensure invoice records are securely stored and easily accessible.

- Audit Trails: Software with built-in audit trails provides a detailed history of invoice activities, reducing disputes and improving transparency.

Consequences of Poor Billing Practices

Ignoring or mismanaging billing processes can lead to significant repercussions for businesses:

- Delayed Payments: Errors or unclear invoices can result in delayed payments, affecting cash flow and operational efficiency.

- Damaged Client Relationships: Repeated billing mistakes, such as duplicate invoices or incorrect charges, erode trust and can harm long-term relationships.

- Financial Losses: Failure to track overdue payments or errors in calculations can lead to revenue leakage.

- Reputational Damage: Unprofessional invoicing practices create a negative impression, potentially leading to lost clients and missed opportunities.

- Legal and Compliance Issues: Non-compliance with invoicing regulations or data protection laws can result in fines and legal challenges.

Conclusion

Avoiding common billing mistakes is crucial for maintaining a business’s financial health and fostering client trust. By adopting preventive measures, leveraging modern tools, and understanding the consequences of poor billing practices, businesses can streamline their invoicing processes and ensure accuracy. Investing time and resources into efficient billing systems pays dividends in the form of improved cash flow, stronger client relationships, and enhanced operational efficiency.